10 Essential Steps to Buying an Apartment in Dubai in 2025

Discover the complete 2025 guide on how to buy an apartment in Dubai. Learn the 10 essential steps, legal requirements, and expert tips for a smooth property purchase.

10 Essential Steps to Buying an Apartment in Dubai in 2025

So, you're thinking about buying an apartment in Dubai? That's an exciting venture! Dubai isn't just a city of towering skyscrapers and luxury shopping malls; it's a global hub where East meets West, offering a unique blend of cultures and opportunities.

In fact, did you know that Dubai's real estate market saw over 111,000 apartment sales transactions last year? This surge highlights the city's booming property market and its appeal to investors worldwide.

But where do you start? Navigating the legal landscape and understanding terms like freehold and leasehold ownership can seem daunting. Don't worry—we've got you covered. In this comprehensive guide, we'll walk you through 10 important steps to buying an apartment in Dubai in 2025. From understanding property laws to finalizing your purchase, we're here to make your journey as smooth as possible.

If you're new to the process, you may want to brush up on Buying an apartment in Dubai: laws, legal steps & more. Let's dive in and unlock the door to your new home!

Key Takeaways:

- Understand Dubai's Property Laws: Familiarize yourself with Law No. 7 of 2006, which governs property ownership in Dubai and allows foreigners to buy property under certain conditions.

- Decide Between Freehold and Leasehold Ownership: Consider your long-term goals and choose between freehold ownership, which grants complete ownership of the property and land, and leasehold ownership, which grants the right to occupy a property for a fixed period.

- Research Freehold Areas in Dubai: Explore popular freehold areas like Downtown Dubai, Dubai Marina, Palm Jumeirah, and Arabian Ranches, and consider factors like lifestyle preferences, proximity to amenities, and investment potential.

- Determine Your Budget and Financial Planning: Calculate your affordability, consider a down payment, and understand costs like agency fees, transfer fees, and deposit requirements for mortgages.

- Get Pre-Approval for Financing: Submit an application with required documents to receive a pre-approval letter valid for 60 days, and plan your finances with an agent to avoid financial challenges during the buying process.

1. Understand Dubai's Property Laws

Assuming you're new to Dubai's real estate market, it's necessary to familiarize yourself with the laws and regulations governing property ownership in the city.

Overview of laws and regulations

At the heart of Dubai's property laws lies Law No. 7 of 2006, which governs property ownership in the city. This law allows UAE nationals, GCC citizens, and foreigners to buy property under certain conditions. As a foreigner, you can own property outright in designated freehold areas, giving you complete ownership of both the property and the land it's built on.

Additionally, you have the option to choose between freehold and leasehold ownership. Freehold ownership grants you complete ownership of the property and land indefinitely, while leasehold ownership gives you the right to occupy a property for a fixed period, usually up to 99 years, but you don't own the land itself.

Importance of understanding property laws

While buying an apartment in Dubai can be an exciting venture, it's crucial to understand the legal landscape to avoid potential pitfalls. Failing to comprehend the laws and regulations can lead to costly mistakes, delayed transactions, or even legal disputes.

On the other hand, having a solid grasp of Dubai's property laws puts you in a stronger position when negotiating terms or dealing with developers and sellers. You'll be better equipped to make informed decisions, ensuring a smooth and successful transaction.

To ensure a hassle-free experience, take the time to familiarize yourself with Dubai's property laws and regulations. This knowledge will empower you to navigate the buying process with confidence, ultimately helping you achieve your goal of owning a property in Dubai.

2. Decide Between Freehold and Leasehold Ownership

Clearly, understanding the differences between freehold and leasehold ownership is a vital step in your property-buying journey in Dubai. As a foreigner, you have the option to choose between these two types of ownership, each with its own set of benefits and considerations.

Benefits of Freehold Ownership

One of the most significant advantages of freehold ownership is that you have complete control over the property and the land it's built on, indefinitely. This means you can make changes to the property as you see fit, without needing to obtain permission from the landlord or developer. Additionally, freehold ownership can provide a sense of security and permanence, as you're not limited by a lease agreement.

Another benefit of freehold ownership is that it can make you eligible for a UAE residence visa, which is a fantastic perk if you're planning to make Dubai your home. As a freehold owner, you'll have more flexibility and freedom to live, work, and invest in Dubai.

Advantages of Leasehold Ownership

Ownership-wise, leasehold properties can be more affordable, making them an attractive option for those who want to invest in Dubai's real estate market without breaking the bank. Leasehold agreements typically have a fixed term, usually up to 99 years, which can provide a sense of stability and predictability.

Leasehold ownership also allows you to occupy a property without shouldering the full responsibility of maintenance and upkeep, which can be a significant cost savings. However, it's necessary to carefully review the lease agreement and understand any restrictions or limitations on making changes to the property.

Between freehold and leasehold ownership, it's crucial to consider your long-term goals and priorities. Are you looking for a sense of permanence and control, or are you more interested in a shorter-term investment opportunity? By weighing the benefits and drawbacks of each option, you'll be able to make an informed decision that aligns with your needs and goals.

3. Research Freehold Areas in Dubai

Unlike other emirates in the UAE, Dubai offers a unique opportunity for foreigners to own property outright in designated freehold areas. As you consider buying an apartment in Dubai, it's vital to research these areas to find the perfect fit for your lifestyle and investment goals.

Popular Freehold Areas in Dubai

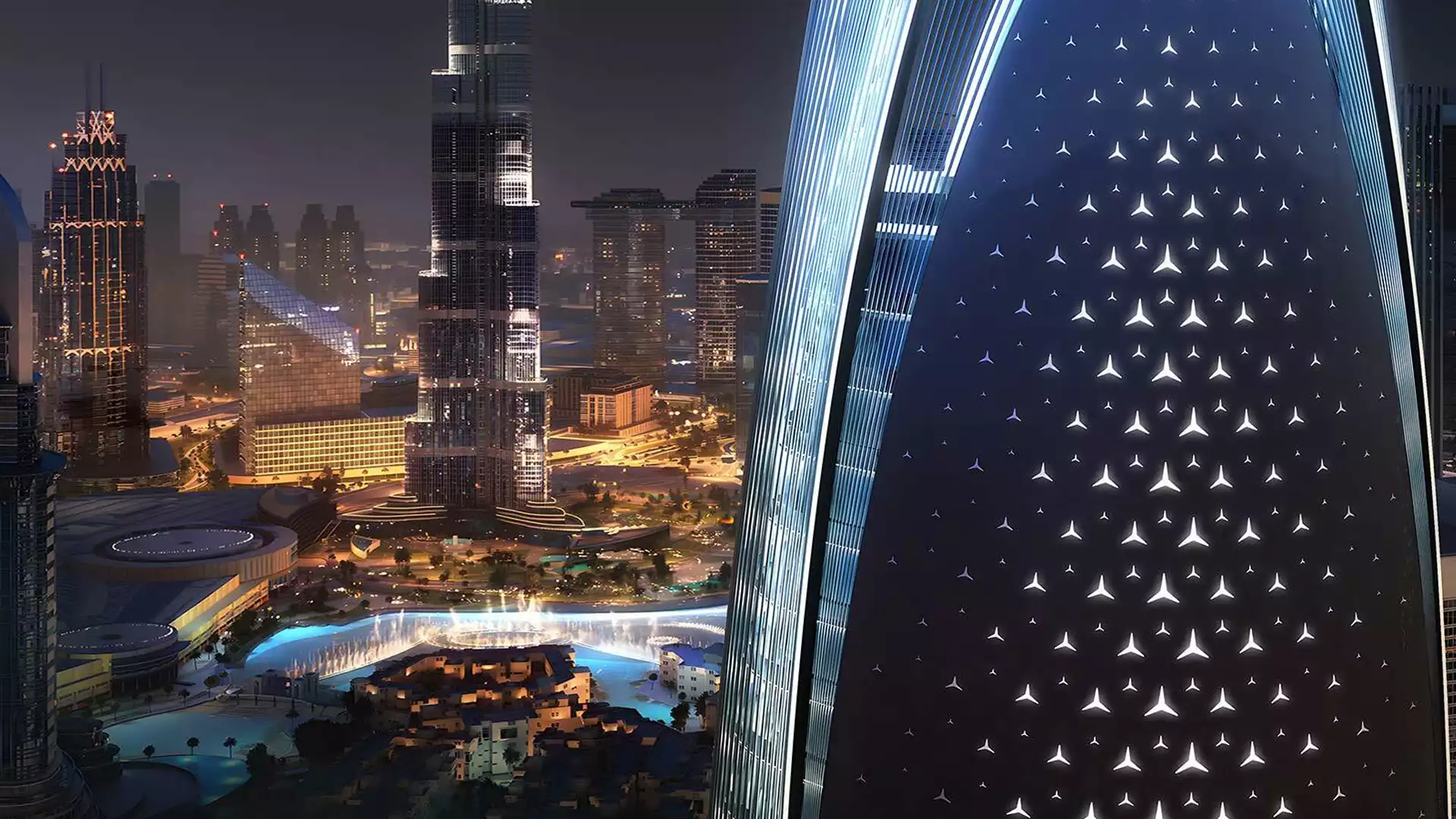

If you're looking for a luxurious lifestyle, you might want to explore areas like Downtown Dubai, Dubai Marina, or Palm Jumeirah. These areas offer stunning views, modern amenities, and a vibrant atmosphere. On the other hand, if you prefer a more suburban setting, Arabian Ranches might be the perfect choice for you.

Some popular freehold areas in Dubai include:

- Downtown Dubai: Known for its iconic Burj Khalifa and luxurious lifestyle.

- Dubai Marina: Offers stunning waterfront views and a vibrant atmosphere.

- Palm Jumeirah: A man-made island with luxurious villas and apartments.

- Arabian Ranches: A suburban area with villas and townhouses.

Factors to Consider When Choosing an Area

Now that you have an idea of the popular freehold areas in Dubai, it's time to consider the factors that matter most to you. Ask yourself:

- Lifestyle preferences: Do you want to be close to the city center or prefer a more suburban setting?

- Proximity to amenities: Are you looking for easy access to schools, hospitals, or shopping malls?

- Investment potential: Are you looking for an area with high rental yields or potential for capital appreciation?

After considering these factors, you'll be able to narrow down your options and find the perfect area that fits your needs and budget.

Area selection is a critical step in the property-buying process. It's vital to research thoroughly and consider multiple factors to ensure you make an informed decision. By doing so, you'll be able to find an area that not only meets your lifestyle needs but also provides a strong potential for investment returns.

4. Determine Your Budget and Financial Planning

Many people underestimate the importance of determining their budget and financial planning when buying an apartment in Dubai. However, this step is crucial in ensuring that you make a well-informed decision that aligns with your financial goals and capabilities.

Calculating your budget

With careful planning, you can avoid financial stress and ensure a smooth buying process. To calculate your budget, you'll need to consider several factors, including your income, savings, credit score, and any outstanding debts. You should also factor in the down payment, which is typically 25% for expats, as well as additional costs such as agency fees, transfer fees, and deposit requirements for mortgages.

Don't forget to account for any hidden costs, such as maintenance fees and utility bills, which can add up quickly. By having a clear understanding of your financial situation, you can make informed decisions about how much you can afford to spend on an apartment.

Considering additional costs

Your budget should also take into account additional costs associated with buying an apartment in Dubai. These may include agency fees, which can range from 2% to 5% of the property's value, as well as transfer fees, which are usually 4% of the property's value.

You should also consider deposit requirements for mortgages, which can vary depending on the lender and the type of property. Plus, you'll need to factor in the cost of registering your property with the Dubai Land Department (DLD), which is a mandatory step in the buying process.

This cost can range from AED 2,000 to AED 10,000, depending on the property's value. By considering these additional costs, you can avoid any unexpected expenses and ensure a smooth buying process.

5. Get Pre-Approval for Financing

Not knowing how much you can afford can lead to disappointment and wasted time. That's why getting pre-approval for financing is a vital step in buying an apartment in Dubai. As How to Buy Property in Dubai if You're Not a Resident? emphasizes, understanding your financial capabilities is crucial in this process.

Importance of Pre-Approval

For instance, having a pre-approval letter in hand gives you an upper hand when negotiating with sellers or developers. It shows that you're a serious buyer who has already secured financing, making your offer more attractive. Moreover, pre-approval helps you focus on properties within your budget, saving you time and energy.

Furthermore, pre-approval can also give you an idea of how much you can borrow, which is necessary in determining your budget. This way, you can plan your finances more effectively and avoid overspending.

Documents Required for Pre-Approval

Preapproval for financing typically requires submitting an application with supporting documents, including:

A salary letter, passport and Emirates ID copies, bank statements, and credit card statements. This information helps lenders assess your creditworthiness and determine how much they're willing to lend you.

This process usually takes a few days to a week, and once approved, you'll receive a pre-approval letter valid for 60 days. Make sure to carefully review the terms and conditions before signing any agreements.

6. Find a Reputable Real Estate Agent

Once again, having a trusted partner by your side can make all the difference in your property-buying journey. A reputable real estate agent can guide you through the process, help you avoid common pitfalls, and ensure all your documents are properly attested and, if necessary, translated into Arabic.

If you're new to investing in Dubai's real estate market, we recommend checking out our comprehensive guide, Investing in Dubai Real Estate: A Comprehensive Guide.

Qualities of a Good Agent

Now, you're probably wondering what makes a good real estate agent. For starters, look for someone who is registered with the Dubai Land Department (DLD) and has extensive knowledge of the local market. They should be able to understand your needs, maximize your chances of finding the perfect property, and provide valuable insights into the buying process.

A good agent will also be able to verify credentials, such as providing references and previous client testimonials. This will give you peace of mind, knowing that you're working with a professional who has a proven track record.

Researching and Interviewing Agents

To find the right agent for you, do your research and interview multiple candidates. Ask them about their experience, their knowledge of the local market, and their approach to finding the perfect property for their clients.

This is also a great opportunity to ask questions about their fees, their communication style, and their availability to show you properties. By doing your due diligence, you'll be able to find an agent who is a good fit for you and your needs.

This step is critical in ensuring a smooth and successful transaction. By working with a reputable agent, you'll be able to avoid common pitfalls and ensure that all your documents are properly attested and, if necessary, translated into Arabic. So, take your time, do your research, and find an agent who will be your trusted partner throughout the buying process.

7. Start Viewing Properties

To find your dream apartment in Dubai, you'll need to start viewing properties that fit your budget and preferences. This is an exciting step, as you'll get to see different apartments, explore various neighborhoods, and get a feel for the local community.

What to look for during viewings

During property viewings, pay attention to the condition of the apartment, including any signs of wear and tear, needed repairs, or maintenance issues. Take note of the building's quality, amenities, and overall atmosphere. Don't forget to ask your agent about the property's history, including any previous sales or rentals.

Also, consider factors like natural light, ventilation, and the apartment's layout. Think about how you'll use the space and whether it fits your lifestyle. Make a list of questions to ask your agent, such as those about the property's management, nearby amenities, and any potential noise pollution.

Tips for finding the right property

You'll want to find a property that meets your needs, fits your budget, and aligns with your long-term goals. Here are some tips to keep in mind:

- Location, location, location: Consider the proximity to your workplace, public transportation, schools, and amenities like grocery stores, restaurants, and gyms.

- Property type and size: Think about the type of property you need, whether it's a studio, one-bedroom, or larger apartment, and ensure it has enough space for your belongings and lifestyle.

- Amenities and facilities: Look for properties with amenities that matter to you, such as a gym, pool, parking, or 24/7 security.

- Resale value: Consider the property's potential resale value and whether it's likely to appreciate over time.

Perceiving the right property is a personal decision, so take your time, and don't rush into anything. Look for properties that resonate with you, and don't be afraid to ask questions or seek a second opinion.

When searching for the perfect property, remember to stay focused on your priorities and don't compromise on what matters most to you. With patience and persistence, you'll find an apartment that fits your needs and becomes your dream home in Dubai.

8. Make an Offer and Sign the Sale Agreement

Keep in mind that once you've found your ideal apartment, it's time to make an offer and sign the sale agreement. This is a critical step in the buying process, and it's important to get it right.

Negotiating the Price

One of the most important aspects of making an offer is negotiating the price. You'll need to decide on a fair market value for the property, taking into account factors like the location, size, and condition of the apartment. Be prepared to negotiate with the seller, and don't be afraid to walk away if the price isn't right. Note, the seller wants to sell, and you want to buy, so there's always room for negotiation.

When making an offer, be sure to include a 10% deposit cheque as security. This demonstrates your commitment to purchasing the property and gives the seller confidence in your offer. Make sure to put your offer in writing and include all the necessary details, such as the price, payment terms, and any conditions.

Understanding the Sale Agreement

To ensure a smooth transaction, it's important to understand the sale agreement thoroughly. The Memorandum of Understanding (MOU), also known as Form F in Dubai, outlines the terms and conditions of the sale. This document will include details like the purchase price, payment schedule, and any contingencies.

When signing the MOU, make sure you have all the necessary documents, including passport copies, Emirates ID copies, and proof of payment. Take your time to review the agreement carefully, and don't hesitate to ask questions if you're unsure about any aspect.

Negotiating the sale agreement can be a complex process, but having a clear understanding of the terms and conditions will give you confidence and peace of mind. Note, this is a legally binding document, so it's crucial to get it right.

9. Obtain a No Objection Certificate (NOC)

Now that you've found your dream apartment and signed the sale agreement, it's time to obtain a No Objection Certificate (NOC) from the developer. This certificate is a crucial document that ensures you have no outstanding fees or approvals pending with the developer.

Purpose of the NOC

The main purpose of the NOC is to confirm that you have cleared all dues with the developer and obtained the necessary approvals for the property transfer. This certificate provides assurance to the Dubai Land Department (DLD) that the developer has no objections to the property transfer, and you're eligible to register the property in your name.

The NOC also protects your interests as a buyer by ensuring that the developer has fulfilled all their obligations, including completing the construction work, obtaining necessary permits, and meeting all regulatory requirements.

Documents required for NOC

Obtain the necessary documents required for the NOC application, which typically include:

Required documents may vary depending on the developer and the property type, so it's important to check with your developer or agent for specific requirements. Some common documents required include:

Additionally, you may need to provide proof of payment for any outstanding fees or dues to the developer. Ensure you have all the necessary documents in order to avoid any delays in the NOC application process.

Important note: The NOC application process and required documents may vary depending on the developer and property type. Be sure to check with your developer or agent for specific requirements to avoid any delays.

10. Transfer Ownership at the Dubai Land Department

All the hard work and preparation have led up to this moment – transferring ownership of your new apartment at the Dubai Land Department (DLD). This is the final step in securing your property, and it's important to get it right.

Documents required for transfer

You'll need to gather and submit a range of documents to complete the transfer process. These typically include:

- Your original sale agreement, also known as the Memorandum of Understanding (MOU) or Form F;

- A No Objection Certificate (NOC) from the developer, confirming that there are no outstanding fees or approvals;

- Proof of payment for the transfer fees and administrative costs;

- And, of course, your passport and Emirates ID copies.

Finalizing the ownership transfer

Any delays or mistakes at this stage can hold up the entire process, so it's vital to ensure that all documents are in order and accurately completed.

Once you've submitted your documents, the DLD will review and process them. This may take some time, so be patient and don't hesitate to follow up if you have any concerns.

Documents play a critical role in finalizing the ownership transfer. Make sure to double-check every detail, as even a small error can cause significant delays. With everything in place, you'll receive your Title Deed, officially certifying your property ownership.

Final Words

Considering all points, buying an apartment in Dubai can seem like a daunting task, but by following these 10 necessary steps, you'll be well-equipped to navigate the process with confidence.

From understanding Dubai's property laws to finalizing your purchase, you've now got a comprehensive guide to help you achieve your goal. Recall, it's necessary to stay informed, plan your finances, and work with reputable professionals to ensure a smooth and successful transaction.

As you initiate on this exciting journey, keep in mind that owning a property in Dubai can be a life-changing experience. With its unique blend of cultures, stunning architecture, and endless opportunities, Dubai has something to offer everyone.

So, take the first step today, and who knows, you might just find yourself unlocking the door to your new home in this incredible city!

FAQs

Q: What is Law No. 7 of 2006, and how does it affect foreign property ownership in Dubai?

A: Law No. 7 of 2006 is a legislation concerning real property registration in Dubai, allowing UAE nationals, GCC citizens, and foreigners to buy property under certain conditions. As a foreigner, you can own property outright in designated freehold areas, giving you complete ownership of both the property and the land it's built on.

Q: What is the difference between freehold and leasehold ownership in Dubai?

A: Freehold ownership gives you complete ownership of the property and land indefinitely, making you eligible for a UAE residence visa. Leasehold ownership, on the other hand, grants you the right to occupy a property for a fixed period (usually up to 99 years), but you don't own the land itself. Leasehold properties can be more affordable, but may have limitations on making significant changes to the property.

Q: What are some popular freehold areas in Dubai that foreigners can consider?

A: Some popular freehold areas in Dubai include Downtown Dubai, Dubai Marina, Palm Jumeirah, and Arabian Ranches. Each area has its unique vibe and amenities, so it's vital to research and consider factors like lifestyle preferences, proximity to amenities, and investment potential.

Q: What documents do I need to gather for the property buying process in Dubai?

A: You'll need to gather vital documents like your passport, visa, proof of income, and sometimes a No Objection Certificate (NOC) from the developer. It's crucial to ensure all documents are in order to avoid delays in the process.

Q: What is the role of a registered real estate agent in the property buying process in Dubai?

A: A registered real estate agent can guide you through the process, help you avoid common pitfalls, and ensure all your documents are properly attested and translated into Arabic, if necessary. They can also help you find the perfect property, negotiate terms, and deal with developers and sellers.