How Indian Citizens Can Buy Property in Dubai's Downtown District?

Learn how Indian citizens can purchase property in Dubai's Downtown District in 2025. This guide covers legal procedures, eligibility, benefits, and step-by-step processes to help you secure your investment.

How Indian Citizens Can Buy Property in Dubai's Downtown District in 2025

Dreaming of owning a slice of Dubai's dazzling skyline? You're not alone! With its world-class infrastructure, tax-free environment, and thriving economy, Dubai's Downtown District has become a magnet for investors worldwide.

As an Indian citizen, the idea of purchasing property in this vibrant city might seem complex, but it's more attainable than you might think. In this guide, we'll walk you through everything you need to know to turn that dream into reality.

And with trusted professionals like richproperty to guide you, the journey becomes even smoother. Let's dive in and explore how you can make Dubai your next investment destination!

Key Takeaways:

- Legal Procedures: Indian citizens must comply with Law No. 7 of 2006 for property ownership, meet eligibility criteria, and navigate FEMA regulations to purchase property in Dubai's Downtown District.

- Due Diligence: Verifying property ownership, ensuring the property is free from encumbrances, and crafting a secure Sale and Purchase Agreement (SPA) are important steps in the buying process, which experts like richproperty can assist with.

- Golden Visa Opportunity: Investing in property in Dubai can lead to a 10-year Golden Visa, offering residency benefits and a high return on investment (ROI) in a strategic location with world-class amenities and lifestyle.

- Financing Options: Indian buyers can explore mortgage options covering up to 80% of property value, with pre-approval processes and currency exchange considerations, making property ownership more accessible.

- Disclosure Requirements: Indian investors must comply with disclosure requirements in India, including reporting under the Foreign Assets Schedule and understanding tax implications, to ensure a smooth investment process.

Understanding the Types of Properties Available

For Indian citizens looking to invest in Dubai's Downtown District, it's crucial to understand the types of properties available. Dubai offers a range of property options, each with its unique characteristics, benefits, and requirements.

- Freehold Properties: These properties can be owned outright, giving you complete control and ownership.

- Leasehold Properties: These properties are owned for a fixed period, usually 99 years, with the land remaining under the ownership of the government or a private developer.

- Jointly Owned Properties: These properties are shared between multiple owners, with each owner holding a percentage of the property.

- Usufruct Properties: These properties grant the owner the right to use and benefit from the property for a specified period.

- Musataha Properties: These properties allow the owner to develop and use the land for a specified period.

Knowing the differences between these property types will help you make an informed decision when investing in Dubai's Downtown District.

Freehold Properties

The concept of freehold ownership is similar to what you might be familiar with in India. As a freehold owner, you have complete control over the property, and you can sell, rent, or pass it down to future generations without any restrictions.

Freehold properties are usually more expensive than leasehold properties, but they offer greater flexibility and long-term security. In Dubai, freehold properties are available in designated areas, such as Downtown Dubai and Dubai Marina. These areas offer a range of amenities, including shopping centers, restaurants, and entertainment options.

Leasehold Properties

If you're looking for a more affordable option, leasehold properties might be the way to go. With a leasehold property, you own the property for a fixed period, usually 99 years, while the land remains under the ownership of the government or a private developer.

At the end of the lease period, the property reverts to the owner of the land. Properties in Dubai's Downtown District, such as those in Burj Khalifa and Dubai Marina, are often leasehold properties. These properties offer a range of benefits, including access to world-class amenities and a prime location. Leasehold properties can be a more affordable option, but it's crucial to carefully review the terms of the lease agreement to ensure you understand the conditions and any restrictions that may apply.

Properties in Dubai's Downtown District, such as those in Burj Khalifa and Dubai Marina, are often leasehold properties. These properties offer a range of benefits, including access to world-class amenities and a prime location.

In fact, according to Why are netizens comparing Gurugram's property market with that of Dubai?, Dubai's property market is becoming increasingly popular among Indian investors.

Important Note: When investing in a leasehold property, it's crucial to carefully review the terms of the lease agreement to ensure you understand the conditions and any restrictions that may apply. Additionally, you should be aware that the property will revert to the owner of the land at the end of the lease period.

Factors to Consider Before Buying

Even as you're excited about the prospect of owning a property in Dubai's Downtown District, it's important to take a step back and consider several factors that can impact your investment.

Some of the key considerations include:

- Legal requirements: Ensure you comply with all legal procedures, including obtaining a No Objection Certificate (NOC) and registering your property with the Dubai Land Department.

- Financing options: Explore mortgage options and understand the pre-approval process, currency exchange considerations, and repayment terms.

- Tax implications: Familiarize yourself with tax laws in both India and the UAE, including reporting requirements under the Foreign Assets Schedule and compliance with the Black Money Act of 2015.

- Residency options: Understand how property ownership can lead to residency in Dubai and the benefits that come with it, such as the 10-year Golden Visa scheme.

- Market risks: Be aware of market volatility and take steps to mitigate risks, such as working with reputable real estate agents and conducting thorough due diligence.

This thorough understanding of the factors involved will help you make an informed decision and ensure a successful investment.

If you're still unsure about the process, you can refer to our comprehensive guide on Can an Indian Resident Buy Property in Dubai? A Comprehensive Guide.

Disclosure Requirements in India

Now that you're considering investing in Dubai's Downtown District, it's important to understand the disclosure requirements in India.

You'll need to report your foreign assets under the Foreign Assets Schedule and comply with the Black Money Act of 2015. This includes disclosing your property ownership and any income generated from it.

It's crucial to understand the tax implications of owning property in Dubai and ensure you're meeting all reporting requirements to avoid any legal issues.

Financing Options for Indian Buyers

Assuming you've found your dream property in Downtown Dubai, the next step is to explore financing options.

Mortgage options are available, covering up to 80% of the property value. You'll need to navigate the pre-approval process with banks and consider currency exchange rates.

With the right financing options, you can make your investment more manageable and ensure a smooth purchase process.

It's important to work with reputable banks and financial institutions to ensure you're getting the best possible deal.

Step-by-Step Guide to Buying Property

Conducting Legal Due Diligence

Assuming you've found your dream property, it's necessary to conduct thorough legal due diligence to ensure a secure and hassle-free transaction. This includes:

Verifying property ownership and ensuring the property is free from encumbrances. A secure Sale and Purchase Agreement (SPA) should be crafted, outlining the terms and conditions of the sale. Experts like RichProperty can assist in this process, providing valuable guidance and support.

Additionally, it's strongly recommended to conduct thorough research on the developer's reputation, property valuation, and market trends to make an informed decision.

Step-by-Step Guide to Buying Property with RichProperty

| Step | Description |

|---|---|

| 1. Hiring a Licensed Real Estate Agent | Partner with RichProperty, a trusted and licensed real estate agent. |

| 2. Selecting the Right Property | Browse through available properties in Downtown Dubai and select the one that fits your budget and preferences. |

| 3. Submitting an Offer and Signing the MOU | Negotiate the price, submit an offer, and sign a Memorandum of Understanding (MOU) with the seller. |

| 4. Obtaining a No Objection Certificate (NOC) | Secure a NOC from the Dubai Land Department, which is required for property transfer. |

| 5. Finalizing the Transfer at the Dubai Land Department | Complete the property transfer process at the Dubai Land Department. |

Understanding the importance of working with a reputable real estate agent like RichProperty can make all the difference in ensuring a smooth and successful property purchase experience.

| Benefit | Description |

|---|---|

| Expert Guidance | RichProperty's experienced team will guide you through the entire process. |

| Time-Saving | Let RichProperty handle the paperwork and administrative tasks, saving you time and effort. |

| Secure Transaction | RichProperty ensures a secure and hassle-free transaction, giving you peace of mind. |

By following this step-by-step guide and partnering with RichProperty, you can confidently navigate the property purchase process in Dubai's Downtown District and achieve your investment goals.

Exploring the Benefits and Opportunities

Keep in mind that investing in Dubai's Downtown District is not just about buying a property; it's about becoming a part of a thriving community that offers a unique blend of luxury, convenience, and growth opportunities.

Exploring the Golden Visa Opportunity

There's no denying that the 10-year Golden Visa scheme is a game-changer for Indian investors. By investing in a property worth at least AED 5 million (approximately ?10 crores), you can secure a 10-year residency visa, giving you the freedom to live, work, and study in Dubai. This long-term residency benefit is a significant advantage, especially for those who want to establish a business or raise a family in Dubai.

Moreover, the Golden Visa scheme offers a range of benefits, including 100% business ownership, no restrictions on business activities, and no requirement for a local sponsor. This means you can enjoy complete control over your business and make the most of Dubai's tax-free environment.

Benefits of Investing in Downtown Dubai

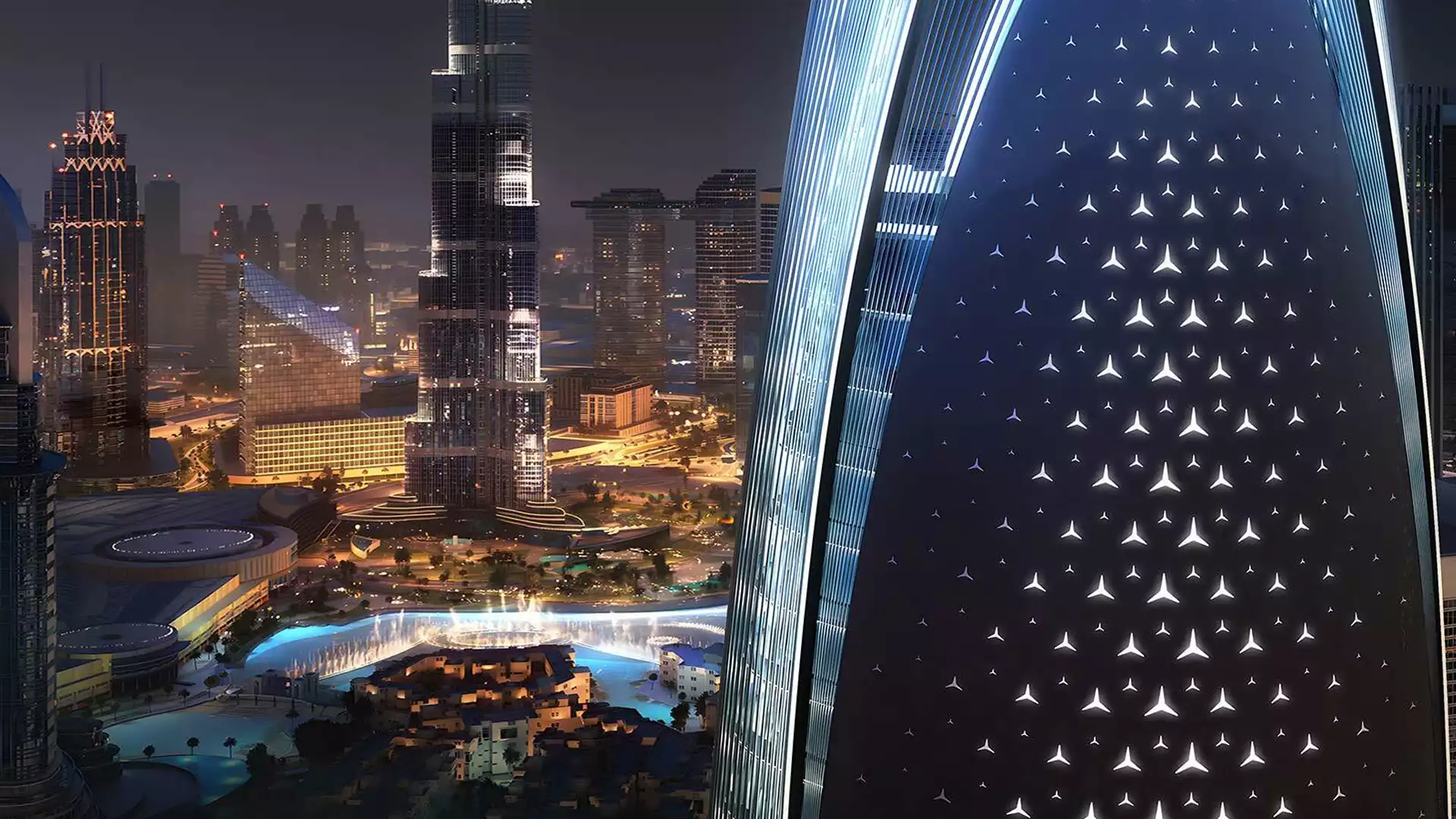

Benefits abound when investing in Downtown Dubai. For starters, the area's strategic location and world-class connectivity make it an ideal hub for business and leisure. You'll be surrounded by iconic landmarks like the Burj Khalifa, Dubai Mall, and Dubai Fountain, ensuring a high return on investment (ROI).

Furthermore, Downtown Dubai offers a world-class lifestyle, complete with luxurious amenities, top-notch healthcare facilities, and a range of dining and entertainment options. And with Dubai's strong economic growth and stability, you can rest assured that your investment will appreciate in value over time.

Dubai's Downtown District is also known for its vibrant cultural diversity, which attracts tourists and businesses from around the world. This diversity, combined with the area's world-class infrastructure, makes it an attractive destination for investors seeking a safe and lucrative investment environment.

Tips for a Successful Investment

Once again, investing in Dubai's Downtown District can be a lucrative opportunity, but it's important to approach it with caution and careful planning. To ensure a successful investment, keep the following tips in mind:

Understanding Legal Procedures for Indian Nationals

Assuming you've done your research and chosen the right property, it's crucial to understand the legal procedures involved in purchasing property in Dubai as an Indian national. This includes complying with Law No. 7 of 2006, meeting eligibility criteria such as holding a valid Indian passport, and navigating the Foreign Exchange Management Act (FEMA) regulations.

For a comprehensive guide on how to buy property in Dubai from India, check out this article. It's also important to note that you'll need to obtain a No Objection Certificate (NOC) and ensure that the property is free from encumbrances. Working with experts like richproperty can help you navigate these complex legal procedures.

Tips for a Smooth Property Purchase

For a seamless property purchase experience, consider the following:

- Work with a reputable real estate agent who has experience in dealing with Indian nationals.

- Be aware of additional costs such as service charges, fees, and property transfer fees.

- Conduct thorough due diligence to mitigate risks like market volatility.

Nationals, it's important to prioritize these factors to ensure a smooth and successful property purchase experience. Any misstep can lead to delays or even losses, so it's crucial to be cautious and informed throughout the process. Additionally, consider the following tips to ensure a smooth property purchase:

- Verify property ownership to ensure that the seller has the right to sell the property.

- Craft a secure Sale and Purchase Agreement (SPA) to protect your interests.

- Plan for financing options, including mortgage availability and currency exchange considerations.

Any failure to comply with these tips can result in costly mistakes, so it's important to prioritize caution and careful planning throughout the property purchase process. Thou shalt not take shortcuts when investing in Dubai's Downtown District!

Weighing the Pros and Cons

After considering the various aspects of buying property in Downtown Dubai, it's vital to weigh the pros and cons to make an informed decision.

| Advantages | Disadvantages |

|---|---|

| High return on investment (ROI) | Higher upfront costs |

| Strategic location and connectivity | Potential market volatility risks |

| World-class amenities and lifestyle | Service charges and overhead costs |

| Strong economic growth and stability | Currency exchange considerations |

| Golden Visa opportunity for residency | Legal and regulatory compliance requirements |

| Tax-free environment | Potential tax implications in India |

| Capital appreciation | Property transfer fees |

| Real estate market growth | Developer reputation and reliability |

| Cultural diversity and lifestyle | Language barriers and cultural adjustments |

Advantages of Buying Property in Downtown Dubai

Clearly, one of the most significant advantages of buying property in Downtown Dubai is the potential for high returns on investment. The area's strategic location, world-class amenities, and strong economic growth make it an attractive option for investors.

Additionally, the Golden Visa opportunity provides a pathway to residency, making it an attractive option for those looking to relocate. Furthermore, the tax-free environment and capital appreciation potential make Downtown Dubai an attractive option for investors looking to diversify their portfolio.

Potential Drawbacks to Consider

Clearly, there are also potential drawbacks to consider when buying property in Downtown Dubai. Higher upfront costs, service charges, and overhead costs can add up quickly. Additionally, market volatility risks and currency exchange considerations can impact your investment.

Buying property in a foreign country can also come with its own set of challenges, including legal and regulatory compliance requirements, language barriers, and cultural adjustments. It's vital to carefully weigh these pros and cons and consider your individual circumstances before making a decision. With the right guidance and knowledge, you can navigate the process smoothly and make an informed investment decision.

Conclusion

From above, it's clear that investing in Dubai's Downtown District is a lucrative opportunity for Indian citizens. With the right knowledge and guidance, you can navigate the legal procedures, conduct due diligence, and secure your dream property in this vibrant city.

By following the step-by-step guide and considering the benefits of investing in Downtown Dubai, you'll be well on your way to reaping the rewards of property ownership in this thriving economy.

So, take the first step towards securing your future and explore the opportunities that await you in Dubai's Downtown District. With trusted professionals like richproperty by your side, you'll have the expertise and support you need to make your investment journey a success. Don't wait – start building your prosperous future today!

FAQs

Q: Can Indian citizens buy property in Dubai's Downtown District?

A: Yes, Indian citizens can buy property in Dubai's Downtown District. According to Law No. 7 of 2006, Indian nationals are eligible to purchase freehold property in Dubai, provided they meet the eligibility criteria, including holding a valid Indian passport and fulfilling security deposit requirements.

Q: What are the popular areas in Downtown Dubai for investment?

A: Downtown Dubai offers various attractive areas for investment, including Burj Khalifa and Dubai Marina. These areas offer high return on investment (ROI), world-class amenities, and strategic locations, making them popular among Indian investors.

Q: What are the tax obligations for Indian investors in Dubai?

A: Indian investors in Dubai are required to comply with tax obligations in both India and Dubai. In India, they need to report their foreign assets under the Foreign Assets Schedule and comply with the Black Money Act of 2015. In Dubai, they can benefit from the tax-free environment, but need to be aware of potential tax implications.

Q: How does property ownership affect residency status in Dubai?

A: Property ownership in Dubai can lead to residency status through the 10-year Golden Visa scheme. Indian investors who meet the investment threshold can apply for the Golden Visa, which grants them residency in Dubai.

Q: What are the financing options available for Indian buyers in Dubai?

A: Indian buyers in Dubai can explore various financing options, including mortgages that cover up to 80% of the property value. They can also opt for pre-approval processes with banks and consider currency exchange considerations. It's imperative to work with reputable real estate agents and financial advisors to navigate the financing process.