Real Estate Investment in UAE for Arab Investors

Explore real estate investment in the UAE for Arab investors. Tax-free returns, Golden Visa, and expert guidance for smart property decisions.

Best UAE Property Investment Guide for Arab Investors

Comprehensive Guide to Real Estate Investment in the UAE for Arab Investors

Why Invest in UAE Real Estate?

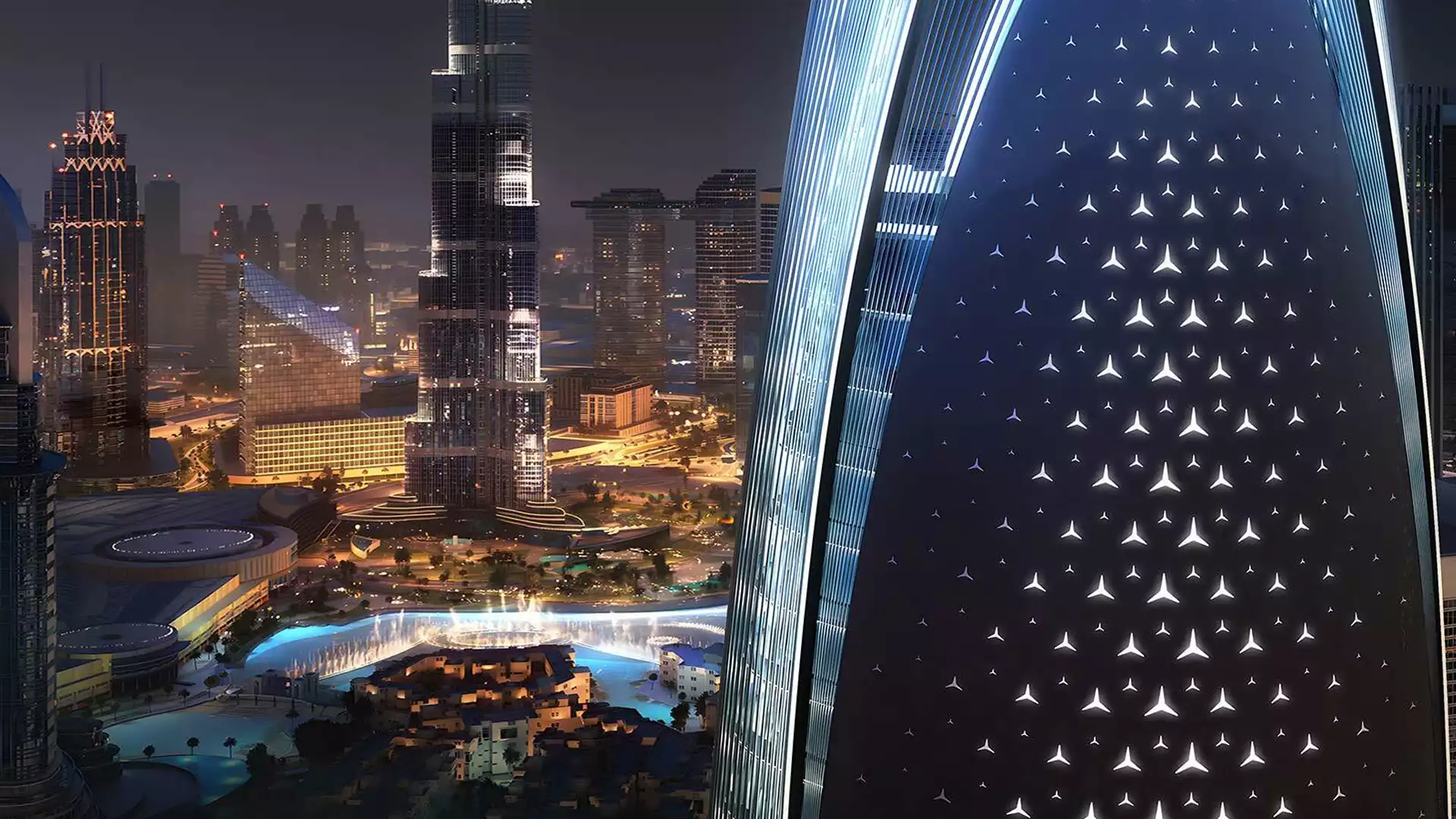

The United Arab Emirates (UAE) is one of the most attractive destinations for real estate investment, offering a stable economy, world-class infrastructure, and investor-friendly regulations. Dubai, in particular, stands out as a global real estate hub, making it a prime location for Arab investors looking for high returns and long-term growth. The UAE is not only a place to live but a land of investment opportunities.

Top Cities in the UAE for Real Estate Investment

1. Dubai

-

Freehold Areas: Dubai offers foreign investors the opportunity to fully own property in designated freehold areas such as Dubai Marina, Downtown Dubai, and Palm Jumeirah.

-

High Rental Yields: Dubai boasts rental yields ranging from 6% to 8%, which is attractive for investors looking for consistent rental income.

-

Golden Visa: Investors who purchase property worth AED 750,000 or more can qualify for a long-term residency visa, making it a compelling option for long-term investment.

2. Abu Dhabi

-

Stable Market: Abu Dhabi offers a stable real estate market with steady rental demand, especially in areas like Al Reem Island and Saadiyat Island.

-

Continued Growth: The city is also witnessing growth through major infrastructure and development projects, offering potential capital appreciation.

3. Sharjah

-

Affordable Prices: Sharjah offers more affordable property prices compared to Dubai and Abu Dhabi, attracting a large number of tenants looking for budget-friendly options.

-

Proximity to Dubai: Its proximity to Dubai makes it an ideal location for investors targeting workers commuting to Dubai.

4. Other Emirates (Ras Al Khaimah, Ajman)

-

Emerging Markets: Emirates like Ras Al Khaimah and Ajman are witnessing growth in the real estate sector, with increasing demand for both residential and commercial properties.

-

Competitive Prices: These areas offer lower property prices, making them suitable for first-time investors.

.jpg)

Advantages of Real Estate Investment in the UAE for Arab Investors

-

Tax Benefits: The UAE does not impose taxes on property income, capital gains, or inheritance, allowing investors to maximize their returns.

-

Legal Protections: The Real Estate Regulatory Agency (RERA) ensures transparency and fairness in property transactions.

-

World-Class Infrastructure: The UAE has state-of-the-art infrastructure, including modern transportation, airports, and ports, making it an ideal place for real estate investment.

Practical Guide to Real Estate Investment for Arab Investors

Steps to Invest in UAE Real Estate

1. Determine Your Investment Goals

It's essential to decide whether your goal is to generate rental income, capitalize on property value appreciation, or a combination of both. Knowing your goals will help you make the right investment decisions.

2. Research the Market

Conduct thorough research on various emirates and neighborhoods to understand market trends, rental yields, and future developments.

3. Legal Considerations

-

Ownership Rights: Ensure the property is located in a freehold area if you're a foreign investor.

-

Registration: All property transactions must be registered with the relevant land department to ensure legal ownership.

-

Residency Visa: Understanding how to obtain a residency visa through real estate investment is crucial for long-term residents.

4. Financing Your Investment

-

Mortgage Loans: Banks in the UAE offer mortgage loans to both residents and non-residents, generally requiring a down payment of 20% to 25%.

-

Developer Payment Plans: Some developers offer flexible payment plans, including post-handover options.

-

Cash Purchases: If you have enough liquidity, you can make a direct cash purchase, speeding up the acquisition process.

5. Property Management

Consider hiring a property management company to handle tenant relations, maintenance, and other operational aspects of your property. This ensures a hassle-free investment experience.

Tips for Successful Investment

-

Diversify Your Portfolio: Spread your investments across various property types and locations to reduce risk.

-

Stay Informed: Keep up with the latest market trends, legal changes, and economic developments to make informed decisions.

-

Seek Expert Advice: Consult with real estate experts, lawyers, and financial advisors to navigate the legal and financial aspects of property investment.

Contact Us Today!

Call Us Now: +971 52 995 6966

Visit Our Website: www.richproperty.ae